On Rental Scale-Up, we often talk about the trend of short-term rental companies moving to long stays (e.g. Airbnb monthly stays, Booking.com long-term rentals), but what do long-stay experts have to say about it? Spotahome is a leader of the mid to long-term stay market, with a strong presence in Europe. The digital housing company has just raised €25m ($29m). We talked with Eduardo Garbayo, VP and Head of Business and Operations, and Jorge Alonso, VP of Product Engineering for Spotahome, to better understand Spotahome’s business model and what they will improve in product and sales terms using the money raised. They will also tell us what Airbnb, Booking.com, and the other short-term rental platforms can learn from Spotahome’s focus on stays over 30 days.

Spotahome was founded in 2014 in Madrid. One of its co-founders, Alejandro Artacho, is still the CEO of the company. First, we asked Eduardo and Jorge to explain what they do at Spotahome:

Jorge Alonso: I currently run three verticals within Spotahome. I run the product engineering and marketing verticals. So essentially I’m responsible for our digital platforms, building, maintaining, and evolving, and everything that has to do with acquisition and branding for Spotahome brands also through my teams.

Eduardo Garbayo: I’m responsible for all businesses, all the local countries that we have, central sales, as well as central operations. And how we transform the company on the operational side.

What kind of mid to long-term listings does Spotahome offer?

Then, we asked the Spotahome team to react to a short description of the company’s business:

Spotahome, it’s more than 150,000 properties in more than 100 cities in 28 countries. Spotahome follows a similar business model to online holiday rentals but instead focuses on finding you a home for stays of a minimum of 30 days, dependent on city regulation. It is an online booking platform offering an exhaustive list of apartments, rooms, studios, and student residences.

Eduardo Garbayo: The only thing I would just make a bit different is that we try not to compare ourselves too much with holiday rentals. Our business is more mid to long term, so we only do stays over 30 days. But we have several-month contracts as well as long-term contracts.

Peace of mind and guarantees for landlords and tenants at the centre of Spotahome’s value proposition

We moved on to talk about Spotathome’s competitive advantage against the OTAs and its more direct competitors, such as Homelike, HousingAnywhere, Nestpick, Wunderflats, and Uniplaces.

Jorge Alonso: As we’re focused on mid to long-term stays, we also try to center our value proposition around peace of mind and security for both tenants and landlords. Because that’s something that, when you move to the online world, you might feel that you might be losing. We try to centre our value proposition along those lines.

This is why we verify, either in person or remotely, most of the homes that we rent on the platform. We also offer guarantees to both tenants and landlords, such as relocation guarantees and damage guarantees. Last year, we launched something that is unique in Europe, on a pan-EU level: We’re offering tenants the possibility of renting with no deposit. At the same time, we offer a guarantee against non-payment and damages to the landlord.

So this is, if we want to sum it up in one word, I would say peace of mind and security as part of bringing the easiness and the hassle-free of the fully online model.

Video: Jorge Alonso and Eduardo Garbayo from Spotahome

Impact of COVID-19 on the long-stay rental market

Rental Scale-Up that talked about another safety topic that rose during the COVID-10 pandemic: The infections in shared accommodations. One of the use cases for Spotahome is enabling students to share together big apartments.

Jorge Alonso: Well, throughout the pandemic, we encountered issues. First, we couldn’t verify homes in person, and this is why we had to innovate and start doing remote verifications. And when it comes to our customers, we noticed that there was a switch from rooms to apartments. And students got stalled a bit and the professional and digital nomads started to use us more in proportion than students.

Once the worst of the pandemic had passed, we recovered part of the audience that we had lost. We ended up with a clear push towards the digital nomad market, but recovering also students which made up a big chunk of our initial audience.

We also noticed that, throughout the pandemic, plenty of the property owners and managers who were into vacation rentals, moved a bit into mid to long-term rentals.

How can Spotahome keep short-term rental providers on its platform, once the tourism market recovers?

We then talked about the big swings in short-term rental supply in key European cities. For instance, in Amsterdam, the stock of short-term rental listings went down by 75%. On top of COVID-19, we see very strong regulations. It is the case in lots of cities from Prague to Paris, London to Brussels, and especially in Spotahome’s home market, Spain (e.g. Barcelona, Valencia, and Madrid). Yet, how about 2022, when travel should recover? Will some of this stock of listings move back to short-term rental platforms? What is Spotahome doing to keep this new supply for you on its platform?

Eduardo Garbayo: Yes, we have seen that in Barcelona, Rome, in Berlin, in all major touristic cities.

I think we see two types of players:

- The ones who are only focusing on vacation rentals. They are just using our platform as a very short-term solution.

- We also see others who are actually testing this business model. They are seeing that there is an opportunity to maximize profitability based on occupation and based on lower costs to manage a property. A lot of them didn’t know this market. They were just purely getting bookings from short-term rental platforms and they were not actually open to long stays until the pandemic struck.

However, as tourism has partially recovered, we have seen that we have kept about 70-80% of them. They are still with us. We have seen a small spike of them offering short-term rentals in August. But most of them are staying with us.

How will Spotahome use the €25 million raised from investors?

We switched topics to talk about their latest financing round of $29 million. Which commercial and technical challenges does the Spotahome team want to solve using part of this money?

Jorge Alonso: The first thing is that we want to continue penetrating the markets where we’re in and we’re going to heavily invest in penetrating those countries where we originally operate. By, first, becoming even stronger in the cities where we are traditionally operating and, second, expanding across different cities within the country. Because we feel that there’s a network effect there if we do that both on the supply and on the demand side.

We also want to test different countries, different geographies. We want to expand from the countries where we’re currently in or where we’ve traditionally operated. We started already in 2021, opening up 28 countries and 100 cities. And we want to double down on that expansion as well.

We’d love to also grow our product engineering team. See if we can solidify this value proposition that I was mentioning before. In 2021, we introduced this new hassle-free value proposition with no deposit. We want to continue moving and doubling down along those lines. We want to be the most competitive in terms of hassle-free security and warranties proposition for both tenants and landlords.

What can Airbnb and Booking.com learn from Spotahome?

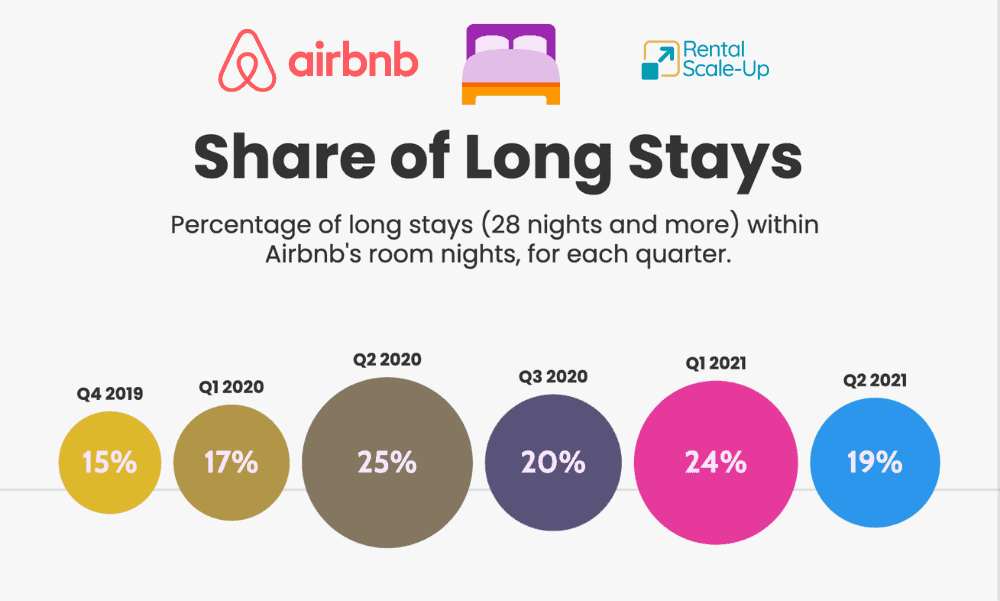

Airbnb has been talking a lot about the long-stay market, especially during the crisis. On one hand, things collapsed so much there were no more short stays, so only long stays. In 2021, it is still a big chunk of their business: 24% of the nights booked in Airbnb in Q1 2021 and 19% of nights booked in Q2 2021.

Booking.com as well is entering the market. They are active in two or three markets, such as the UK and the US. We asked Jorge and Eduardo what they thought Airbnb or Booking.com can actually learn from Spotahome.

Eduardo Garbayo: First of all, we respect Airbnb and Booking. So we consider they are two companies we can learn from them, so that’s clear.

Although yes, as for mid and long-term rentals, we have been there for longer. I think we are the experts, at least in Europe. We are the retail platform of reference. In our experience, mixing both businesses, short-term and mid-term, is not that easy. Either the players have different portfolios, one dedicated to short-term and one dedicated to long-term, or it’s quite difficult to complement.

Why is that? Because short-term usually receives more monthly revenues. However, it also has higher costs to manage and lower occupancy. Short-term rental prices are super high. So, convincing someone to drastically reduce the price to match the terms of the mid-term rentals market is difficult.

In terms of occupancy, there is an issue too when mixing short and long-term stays in one calendar. If you have a lot of small bookings across the whole calendar, it’s very difficult to have enough availability to satisfy long-term stays. Also, you have other complexities of the mid-term market, such as different regulations per market. In some places, we are considered real estate agents, have different rental contracts, different taxes, and various deposit rules.

So, we believe it’s fairly complex and a challenge for Airbnb and Booking.com. And honestly, when they say 24% or 19% of nights, how many or what proportion are those in number of bookings or even in revenue? Maybe that’s even a bit less. So our question mark is whether once COVID is fully out, are the OTAs going to keep this as a line of business? Are they going to get back to short-term rentals only and reduce priorities? We don’t know, so let’s see.

How do the Sonder and Spotahome business models differ?

We then talked about Sonder, a company straddling the PropTech and Short-Term Rental worlds. They provide hotel-like apartments with services, lease out big buildings and guests can have fully furnished apartments in there for a good price. They do basically everything from A to Z, from getting the booking to delivering the guest experience. How does it differ from Spotahome?

Eduardo Garbayo: We consider Sonder a very relevant company with quality apartments, so again, we respect Sonder as a company.

The reason why I would tell you it’s better to book through Spotahome is that we are in a lot of markets and we try to give you the same guarantee, same experience across different markets. So whether you want to go to one market, whether you want to go to another market, having Spotahome there is always a kind of trust.

Second, you will have more choices and availabilities with Spotahome. With Sonder, they will have their portfolio. We will have the portfolio of Sonder, we have the portfolio of hundreds of other companies. So you’ve got more opportunities to choose from. Maybe you want Sonder-like apartments, maybe you want another kind of apartment with a different budget or a different quality standard.

Third, with Spotahome, you have an independent party that helps you in case there is an issue between the tenant and the landlord. Sonder will be themselves managing the properties, so you are just dealing with the landlord. You are dealing with the person actually having the interest in maximizing their occupation. I’m not saying Sonder is not going to offer you a good quality service, but you may have companies that may not give you the best quality service. So having someone that that supports you in case there is trouble, who can relocate you to another apartment, who gives you the guarantee that if you have an issue, you will be covered. And you have a customer service that speaks eight languages.

Spotahome’s plan for 2022

Eduardo Garbayo: Our goal this year is to become not only the most relevant digital platform for rentals, midterm and long term, in Europe but also the number one by far in a lot of markets. So further gain market share in our 11 core cities, to be able to extend our operations to 50 plus cities in our core countries. And to fully launch the 22 new countries we have started entering. So at least double or even triple our business with our current margins, which have been really good margins on the last year.

Additional notes on Spotahome, by Rental Scale-Up:

How does SpotAHome make money? What are Spotahome fees?

The company takes a reservation fee from tenants and a service fee from property owners, based on the total contract value.

- The “Total Contract Value” is the total price of the reservation for the rental property, which will vary according to the total duration and set price for each day for its duration.

- The “Reservation Fee” is (i) a percentage of the Total Contract Value plus the Value Added Tax (VAT) or (ii) a fixed price plus de Value Added Tax (VAT) charged by SPOTAHOME to the Resident for the provided services.

- The “Service Fee” is a percentage of the Total Contract Value that SPOTAHOME will charge the Owner for the provided services.