Two months after our February article called European holiday rental market 2021 perspectives darker than US, the gap between the two continents still looks strong. According to data experts such as AirDNA, the US vacation rental industry is on track for its best year ever, with strong Spring bookings in coastal and rural areas and already a lot of reservations for the summer. Meanwhile, in Europe, summer does look promising. But Spring 2021 remains slow, amid existing and new travel restrictions, continuing lockdowns, and slow vaccine roll-out.

March 2021 data in the US: The best year ever?

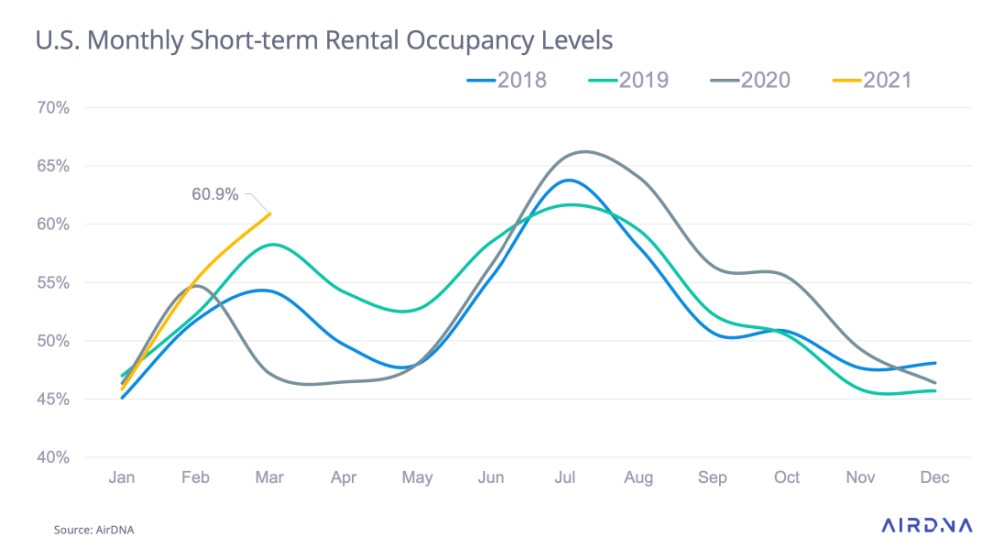

AirDNA is a leading vacation rental data provider that creates monthly reports about the state of the industry. In previous articles, we looked at their January and February 2021 reports. AirDNA’s March 2021 data show that occupancy levels in the US (all markets included) were higher than in the same period in 2020 AND in 2019 (pre-pandemic):

US STR Occupancy levels (March 2021):

- 58.2% in March 2019,

- 47.2% in March 2020,

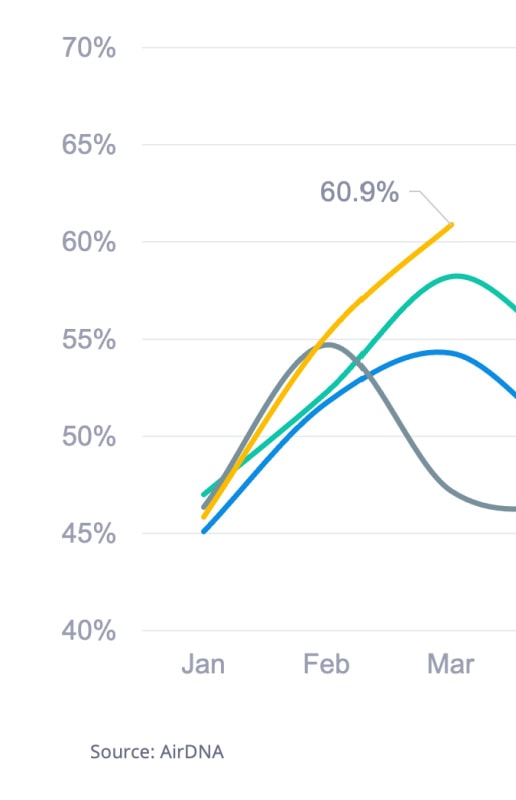

- 60.9% occupancy in March 2021.

Graph: Occupancy levels, 2018 -2021

Graph: Zooming in on Q1 2021 data

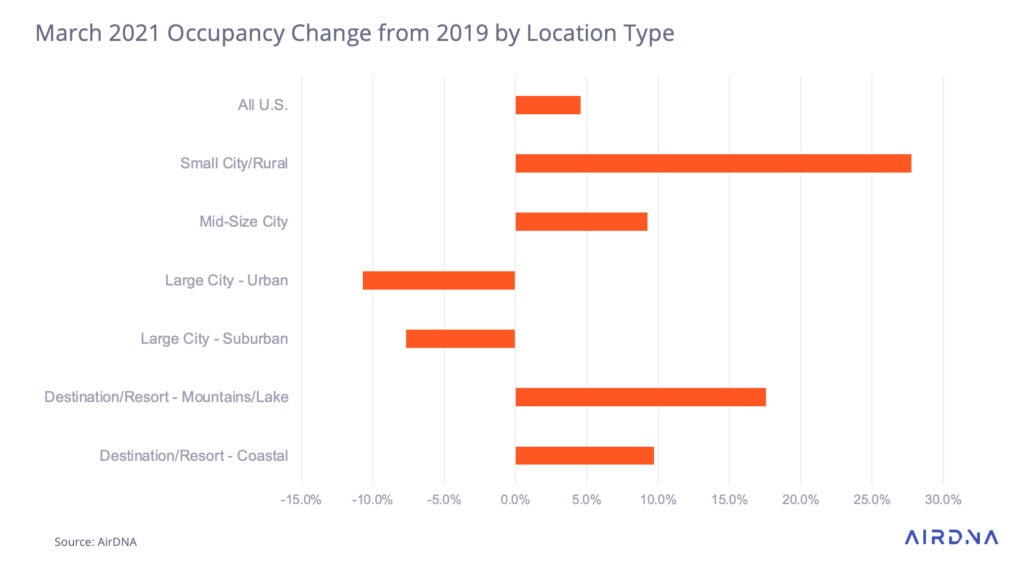

While large urban markets remain depressed, coastal states like Florida benefited from strong Spring Break-related demand. Yet, rural states have also been performing well. As shared in our article about how Airbnb is capitalizing on the rural vacation rental market boom, occupancy in small city & rural markets was higher in March 2021 than in pre-pandemic 2019.

Change in occupancy (2021 vs 2019):

- +4% for the overall US

- +27% for small city and rural markets

- +17% for mountains / lake

- +9% for coastal / sea

- -11% for large city – urban

Overall, the AirDNA team thinks that demand is already so strong that 2021 is shaping up to be the best year ever for short-term rentals in the US. In non-urban markets, the strength of demand and the limitations of supply (as owners will be using their secondary homes more than usual) will drive rates (ADR) up.

As the vaccine roll-out accelerates in the US, urban markets should start reviving and do much better than in 2020.

A last factor that could drive bookings up is that a lot of Americans have a stock of paid vacations that they need to spend. For once, Americans may take weeks off this summer, just as Europeans usually do.

April 2021 data in the US and in Europe (source: Transparent)

Transparent, another vacation rental data provider, has a coronavirus recovery tracker. We have selected a few graphs from it, showing data for week 13, 2021 (March 29 to April 4).

This first graph shows the evolution of vacation rental bookings per week, across the world. The 2021 data is compared against 2019, a pre-pandemic year.

In week 13 of 2021, North America (US + Canada + Mexico) numbers were very close to 2019, at -4%. Actually, is the US would have been taken on its own, the numbers would be very positive. By contrast, Europe is lingering at -62%.

Let’s focus on European countries, as of late March / early April. Here’s the variation of the number of bookings compared with the same period in 2019:

- UK: -46%

- France: -51%

- Spain: -63%

- Italy: -79%

Note that, in terms of new bookings, late February was actually better in both the UK and France: At that time, there was a rush of bookings due to Prime Minister Boris Johnson’s end of lockdown timetable, while, on the side of the Channel, travel restrictions had not kicked in yet.

Transparent has also created this map of reservations in Europe, as of week 13. Let’s have a look at the green areas, i.e. where reservations actually increased:

- In the UK, Scotland and Nothern Ireland had still not announced their plan to reopen hospitality businesses. Meanwhile, holiday rentals and cottages were to officially reopen on April 12 in England and Wales, creating a lot of booking for these parts of the country.

- Sweden did not enforce strong restrictions on vacation rentals and people booked places to social distance and enjoy a respite from the bigger cities

- In The Netherlands and Belgium, the respective greener eastern parts of the countries (Drenthe and Ardennes) attracted a lot of domestic travelers

- France was on the verge of a 3rd lockdown, prompting people to cancel existing bookings, but also to create new bookings to ride the lockdown away from Paris

- Travel restrictions and curbs on hospitality businesses of varying degrees remained in place in Southern Euripe

Just as in Europe, the boom in vacation rental bookings is not uniform in the US. Coastal states such as Florida and rural states such as West Virgina, and Kansas have doing well. The Carolinas, which offer both rural and coastal markets, are also winners.

Travel restrictions and city lockdowns on the West Coast clearly hindered bookings, but local markets like Lake Tahoe were actually booming.

Not all gloom

What the US and England cases show is that bookings can surge back fast, when timetables are clear and/or vaccine roll-out is going well. For instance, the French lockdown should be lifted by mid-May: People will be able to travel for more than 10km around their homes and will surely start booking vacation rentals again.

If spring remains bleak in Europe, pent-up demand should play out as in 2020, when summer was packed in traditional vacation rental areas. Coastal, rural, and mountain markets should so well in Europe, while urban markets in the US should start reviving too. European markets may be eve get a small boost from Americans willing to travel, as the E.U. is set to let vaccinated U.S. tourists visit this summer. Maybe Tuscan and Greek villa operators could reach out to their past US guests to see whether they are willing to come back in 2021.